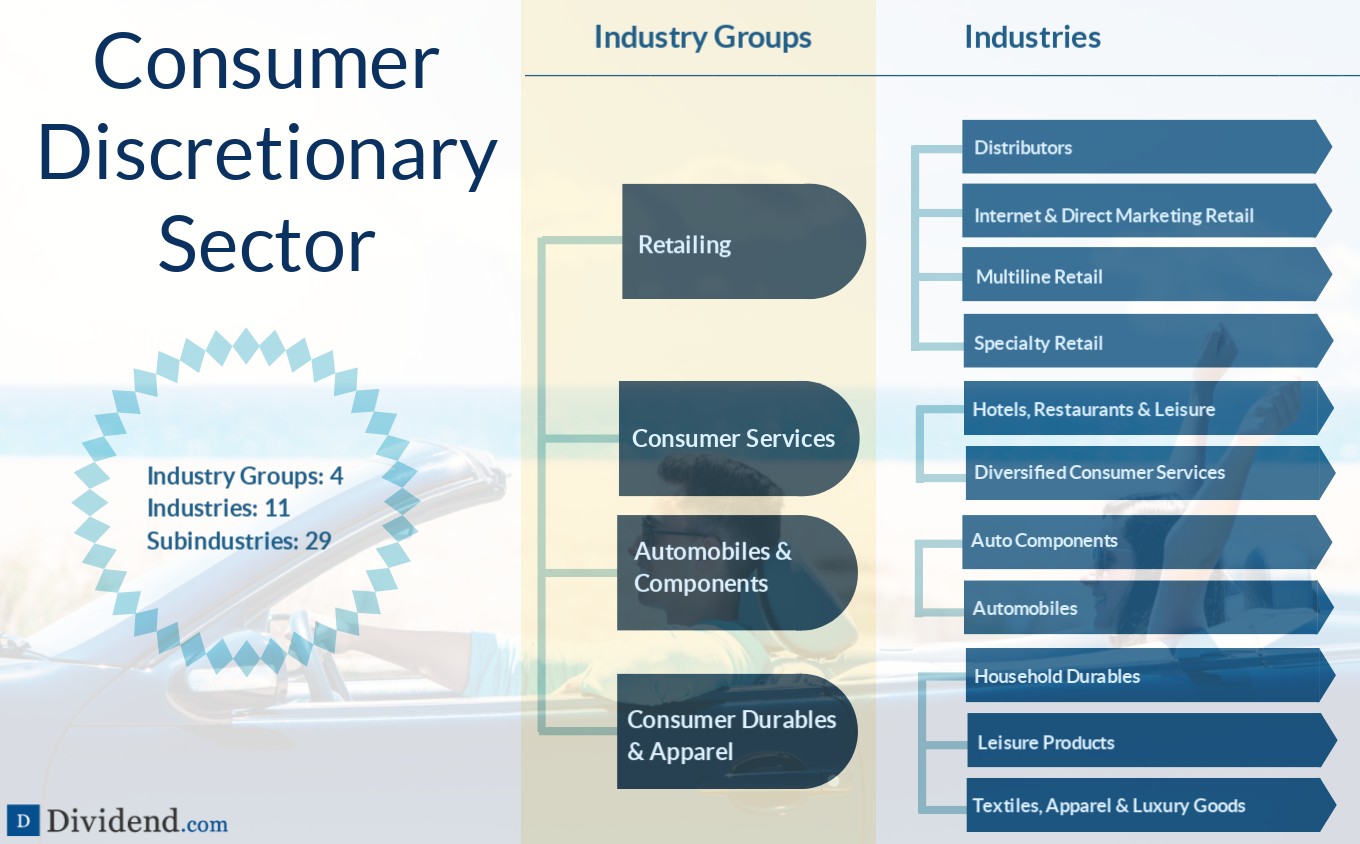

Consumer Discretionary Sector breakdown

The industries that are most susceptible to economic cycles are included in the consumer discretionary sector. The companies in the consumer discretionary sector are primarily involved in the following activities:

1. Manufacturing consumer goods such as luxury goods, apparel, durables, and leisure products.

2. Retailing as distributors, internet and direct marketing retailers, specialty retailers, and multiline retailers like department stores.

3. Providing consumer services such as dining establishments, lodging, and gaming establishments

4. Manufacturing automobiles and automobile parts.

Magna International's 4.3 percent decline over the last week is what caused the Consumer Discretionary industry to decline by 2.1 percent overall. However, the sector has decreased by 26% in the last 12 months. Earnings are anticipated to increase by 17% yearly.

Consumer discretionary stocks are cyclical stocks because their prices frequently fluctuate along with the overall economy. Even though the COVID-19 pandemic caused many consumer discretionary companies to face previously unheard-of difficulties, investors now have a special opportunity in the industry.

In this sector, concentrating on well-known companies and market leaders is typically a recipe for success; the top stocks have historically produced profits for investors. Since many of these businesses have taken market share from struggling competitors and have more financial resources to invest in the recovery, they should also come out of the epidemic stronger.

SECTOR ANALYSIS

Current Industry PE

Investors' pessimism about the sector shows that they believe long-term growth rates will be lower than they have been in the past. Compared to its three-year average PE of 26.8x, the industry is currently trading at a PE ratio of 14.1x. The sector is trading very close to its PS ratio of 0.96x during the past three years.

Past Earnings Growth

Over the previous three years, revenue and earnings for businesses in the consumer discretionary sector have mostly held steady. This indicates that earnings have been fairly constant throughout this time due to reasonably stable sales and operating costs.

Industry PE

The Online Retail and eCommerce industry, which is trading above its 3-year average PE ratio of 42.5x, has investors' highest levels of optimism. Investors are prepared to pay a premium for the 62 percent annual earnings increase that analysts anticipate. The Consumer Durables industry, which is trading below its 3-year average of 13.8x, is the one that investors are the most gloomy about.

Forecasted Growth

The Online Retail and eCommerce industry, which is trading above its 3-year average PE ratio of 42.5x, has investors' highest levels of optimism. Investors are prepared to pay a premium for the 62 percent annual earnings increase that analysts anticipate. The Consumer Durables industry, which is trading below its 3-year average of 13.8x, is the one that investors are the most gloomy about.